Market Wrap

Narratives

Week Ahead

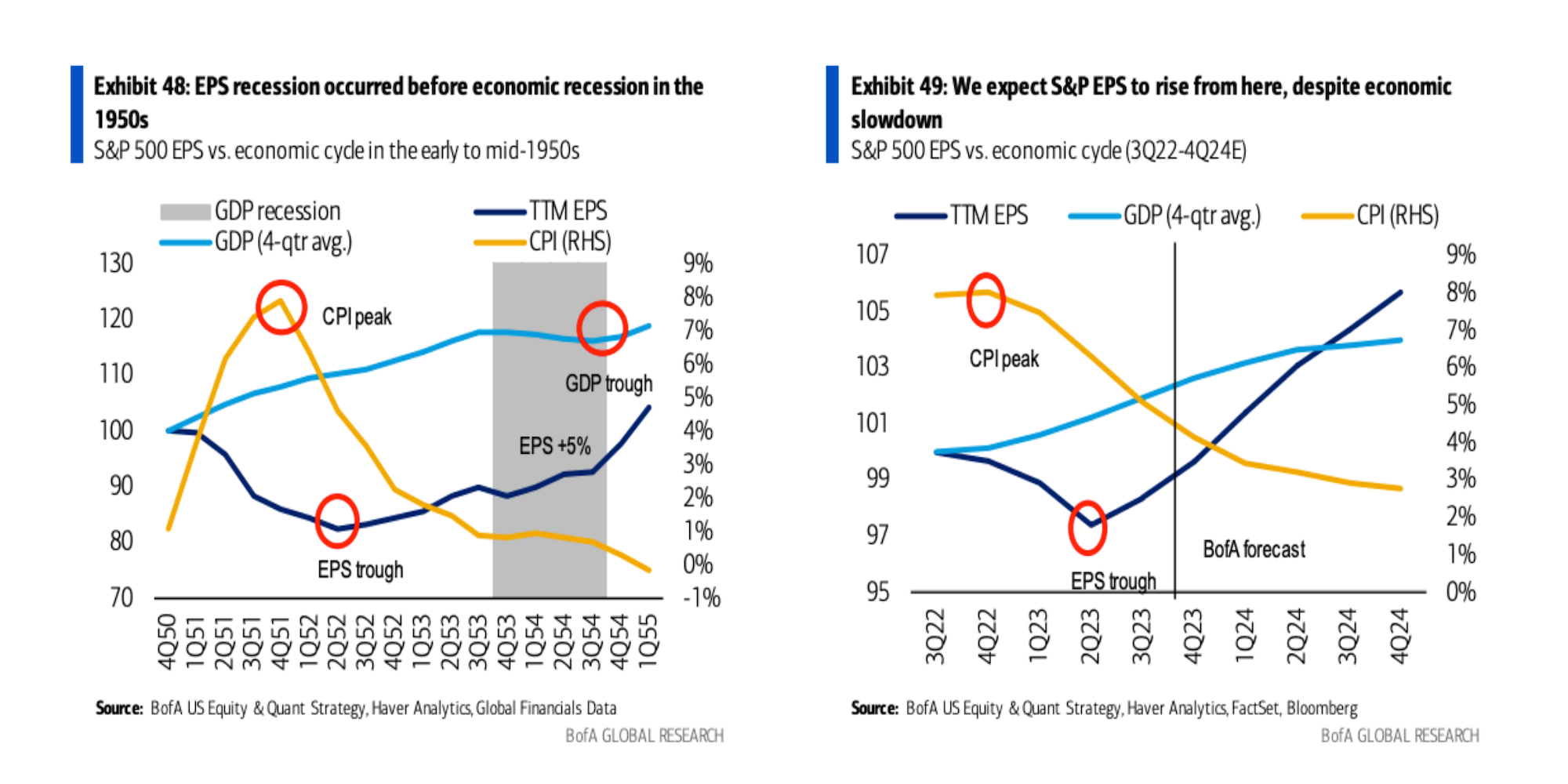

It is anticipated that PCE price inflation slowed to 3.1% last month, marking the lowest rate since March 2021. The core rate is expected to ease to 3.5%, the lowest in over two years. Additionally, US GDP growth is expected to be revised higher to 5% from the initial 4.9%. This can be attributed to accelerated consumer spending and robust exports.

The ISM data is expected to indicate a continued contraction in the manufacturing sector. Furthermore, insights into the US central bank's policy direction will be sought from speeches by several Federal Reserve policymakers, including Chair Powell's remarks scheduled for Friday.

Other important data to watch includes new and pending home sales, Case-Shiller home prices, and advance estimates of the goods trade balance and wholesale inventories. Additionally, the earnings season will continue with expected results from Intuit, CrowdStrike, Workday, Snowflake, Synopsys, Salesforce, VMware, and Dell - Trading Economics

Earnings

| Metric | UpDn | This Week | Prior Week | Baseline | Baseline TF |

|---|---|---|---|---|---|

Forward 4-qtr Estimate | 🔴 | 235.82 | 235.95 | 228.39 | January 1, 2023 |

Forward 4-qtr PE | 🔵 | 19.3 | 19.1 | 17.2 | January 1, 2023 |

Nominal Earnings Yield | 🔴 | 5.17 | 5.23 | 5.86 | January 1, 2023 |

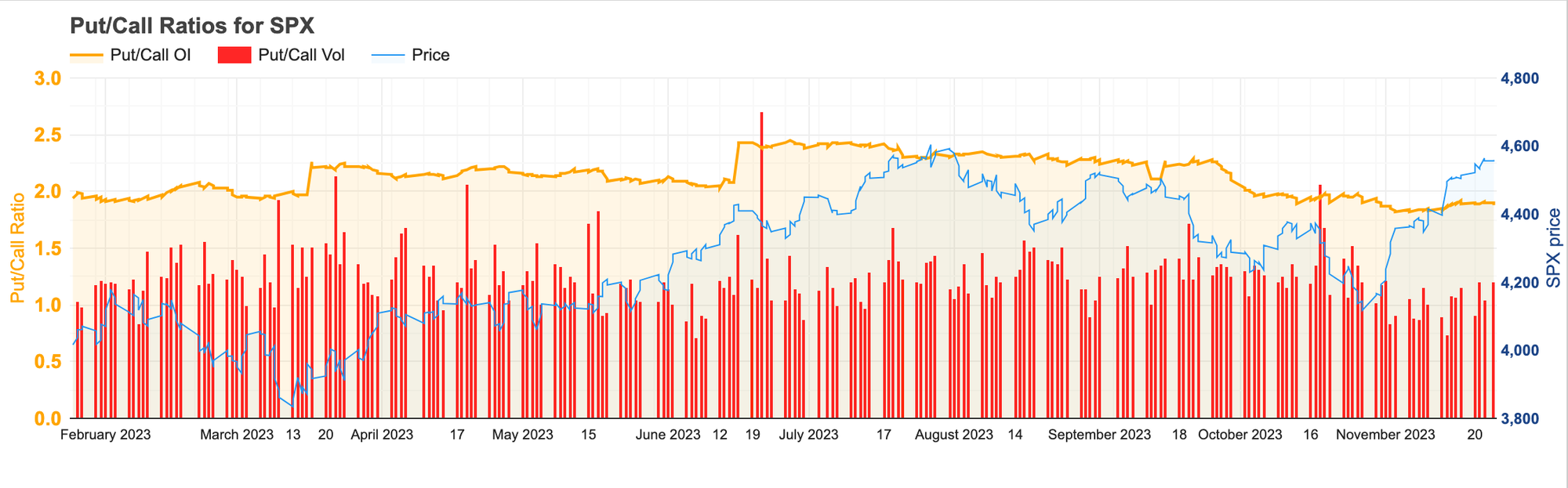

Options

| Metric | UpDn | This Week | Prior Week | Net CHG | % CHG |

|---|---|---|---|---|---|

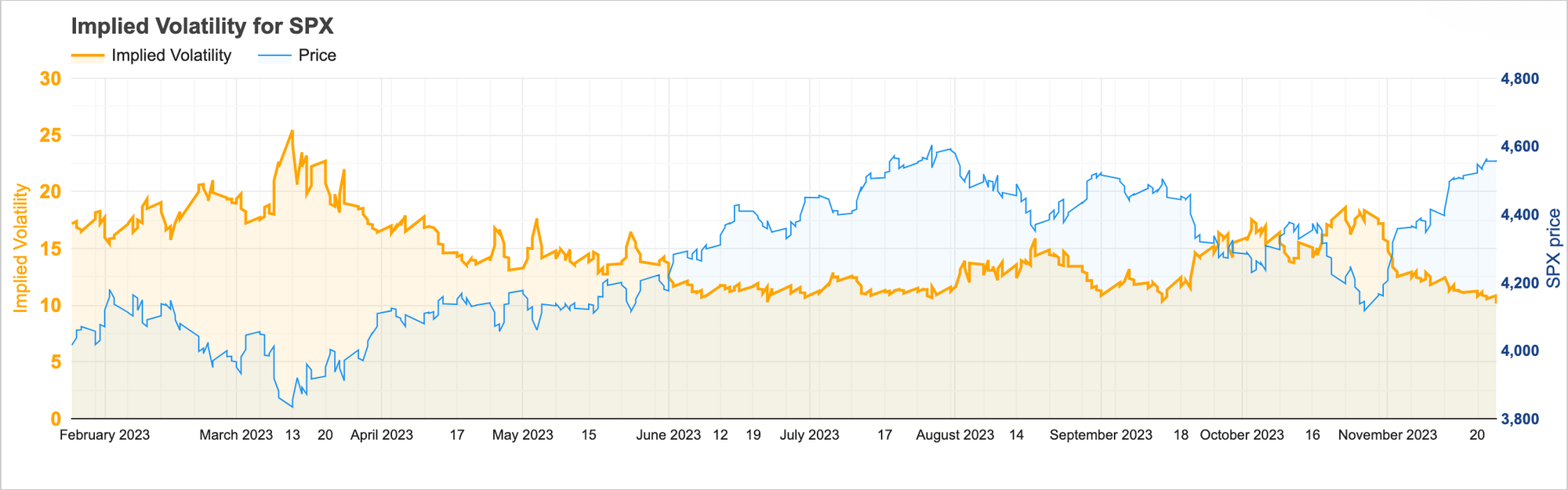

SPX Implied Volatility | 🔴 | 10.16 | 11.14 | -0.98 | -8.8% |

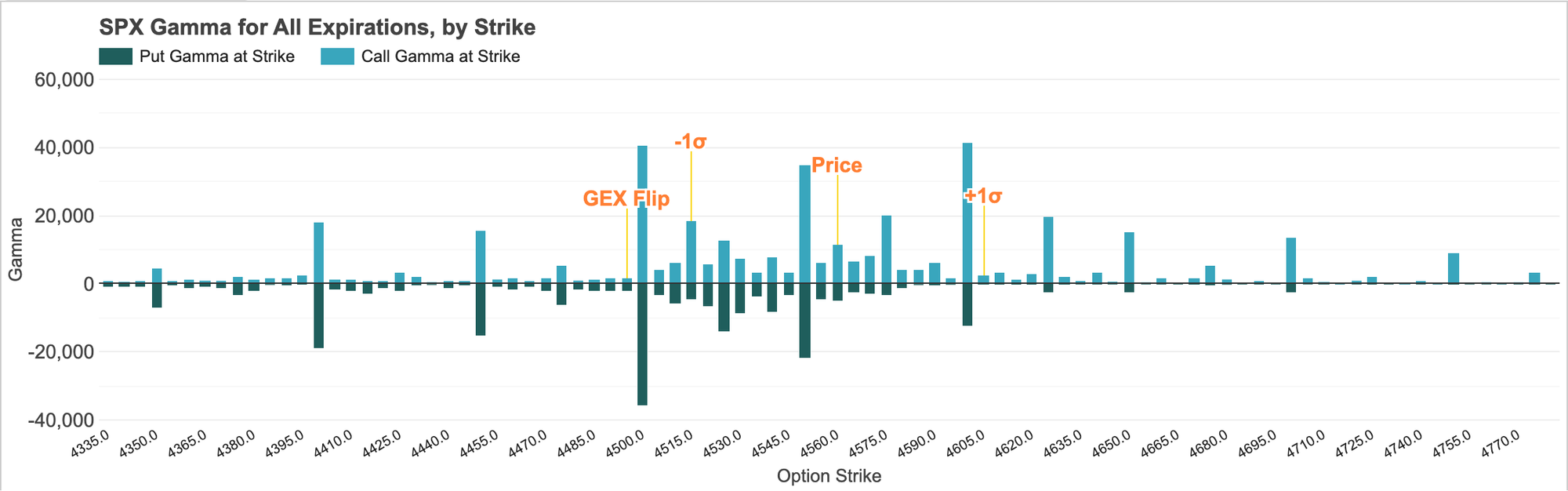

SPX GEX Flip | 🔵 | 4,497.5 | 4,442.5 | 55 | 1.24% |

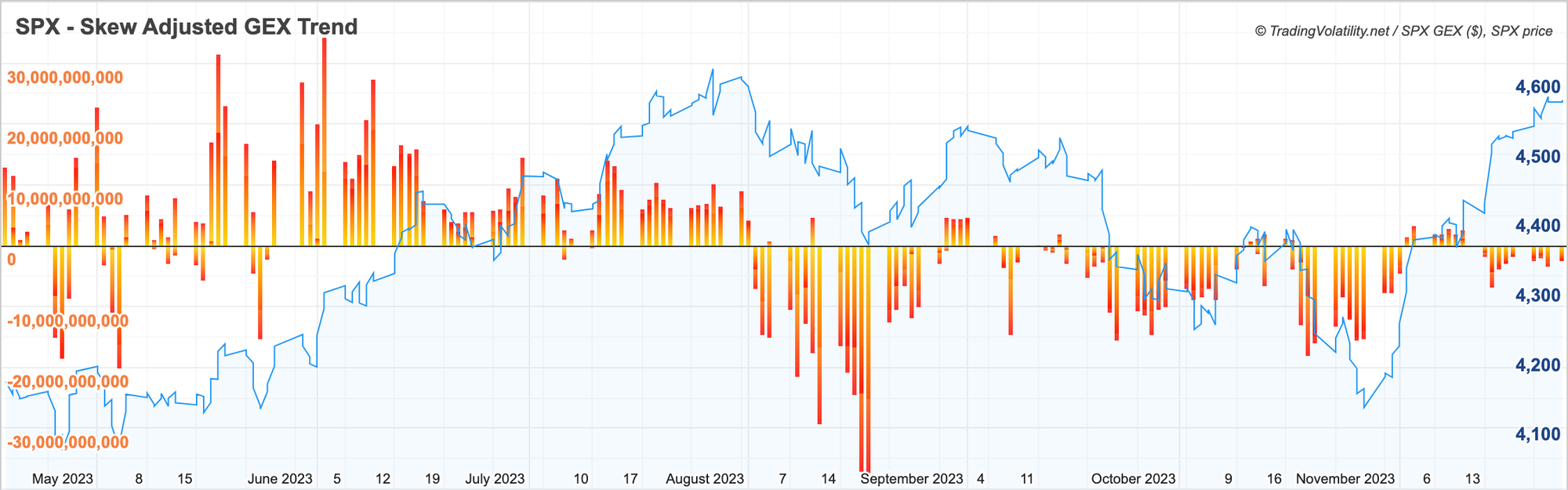

SPX Skew Adjusted GEX | 🔴 | -2,534,779,228 | -1,963,747,224 | -571,032,004 | -29.08% |

Equity Put/Call Ratio (CBOE) | 🔵 | 0.91 | 0.54 | 0.37 | 68.52% |

VIX Put/Call Ratio (CBOE) | 🔵 | 0.46 | 0.41 | 0.05 | 12.2% |

SPX/W Put/Call Ratio (CBOE) | 🔵 | 1.83 | 1.46 | 0.37 | 25.34% |

Futures

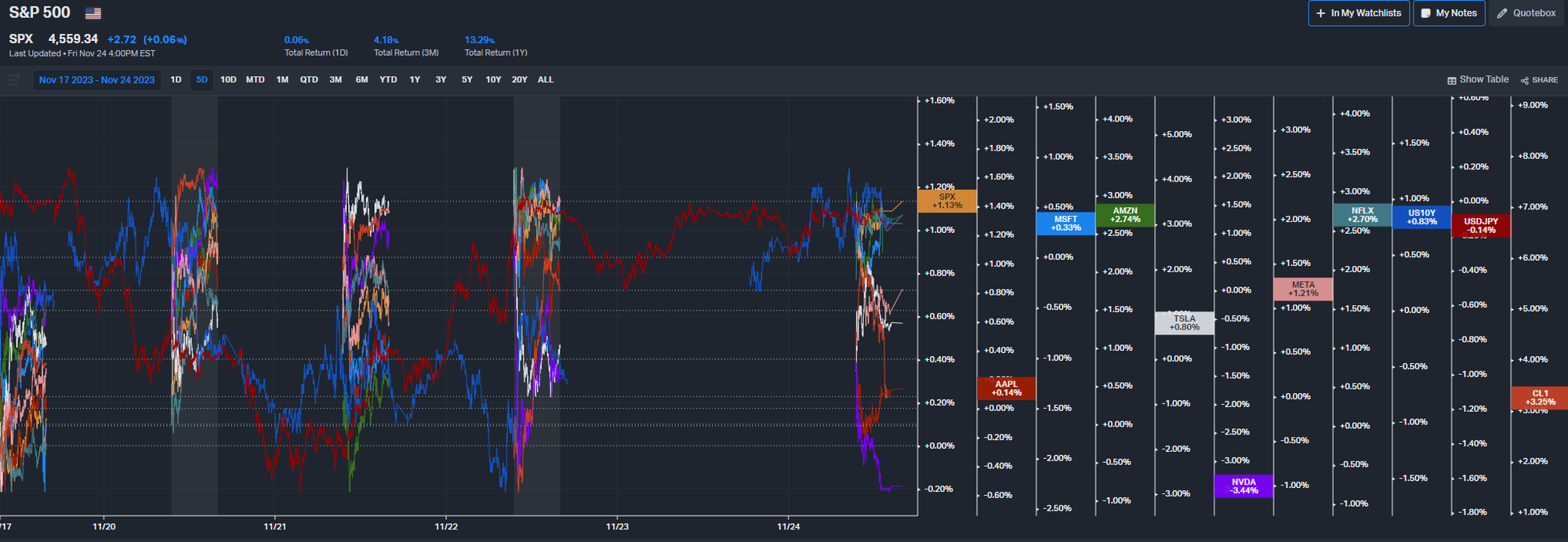

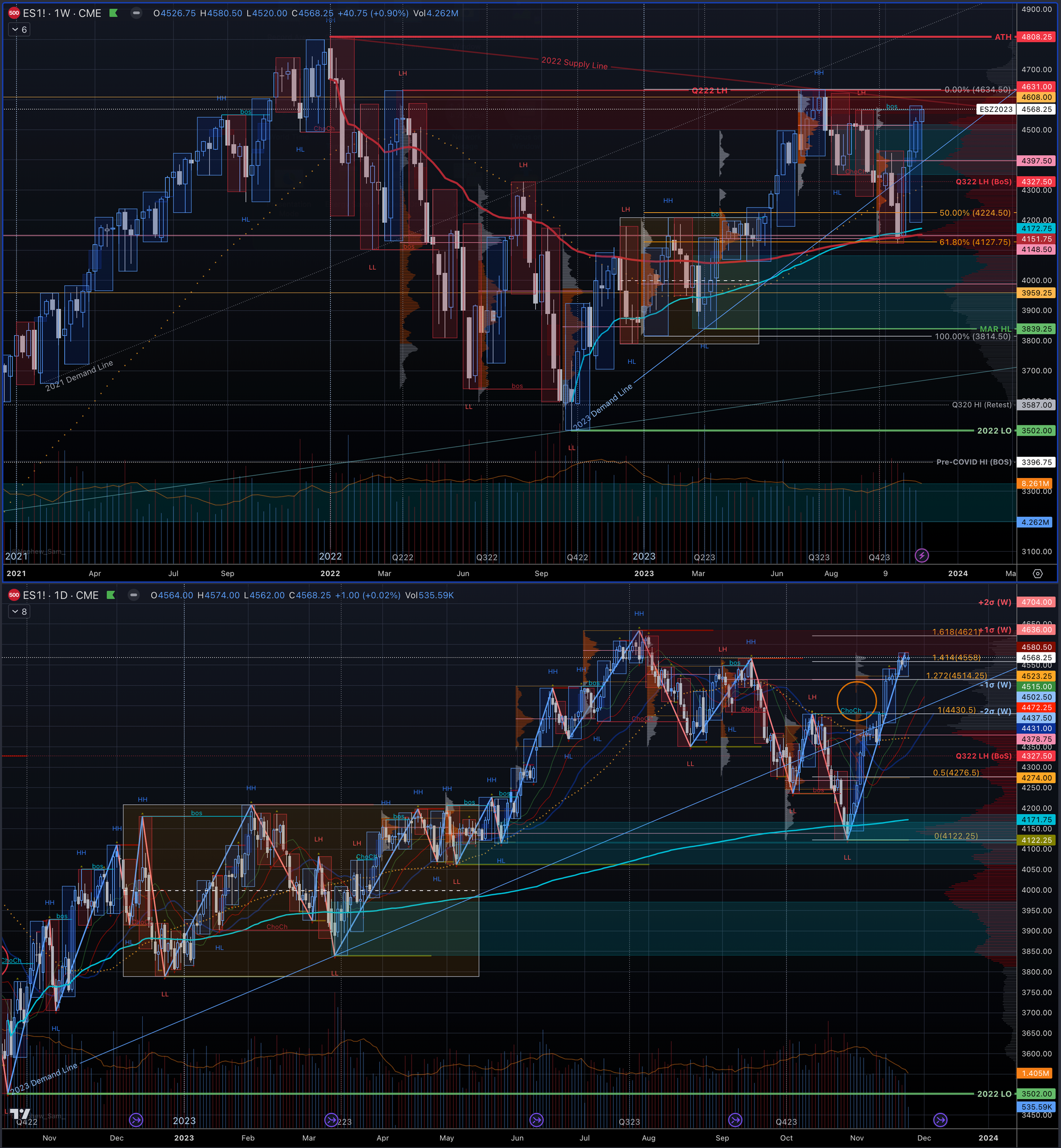

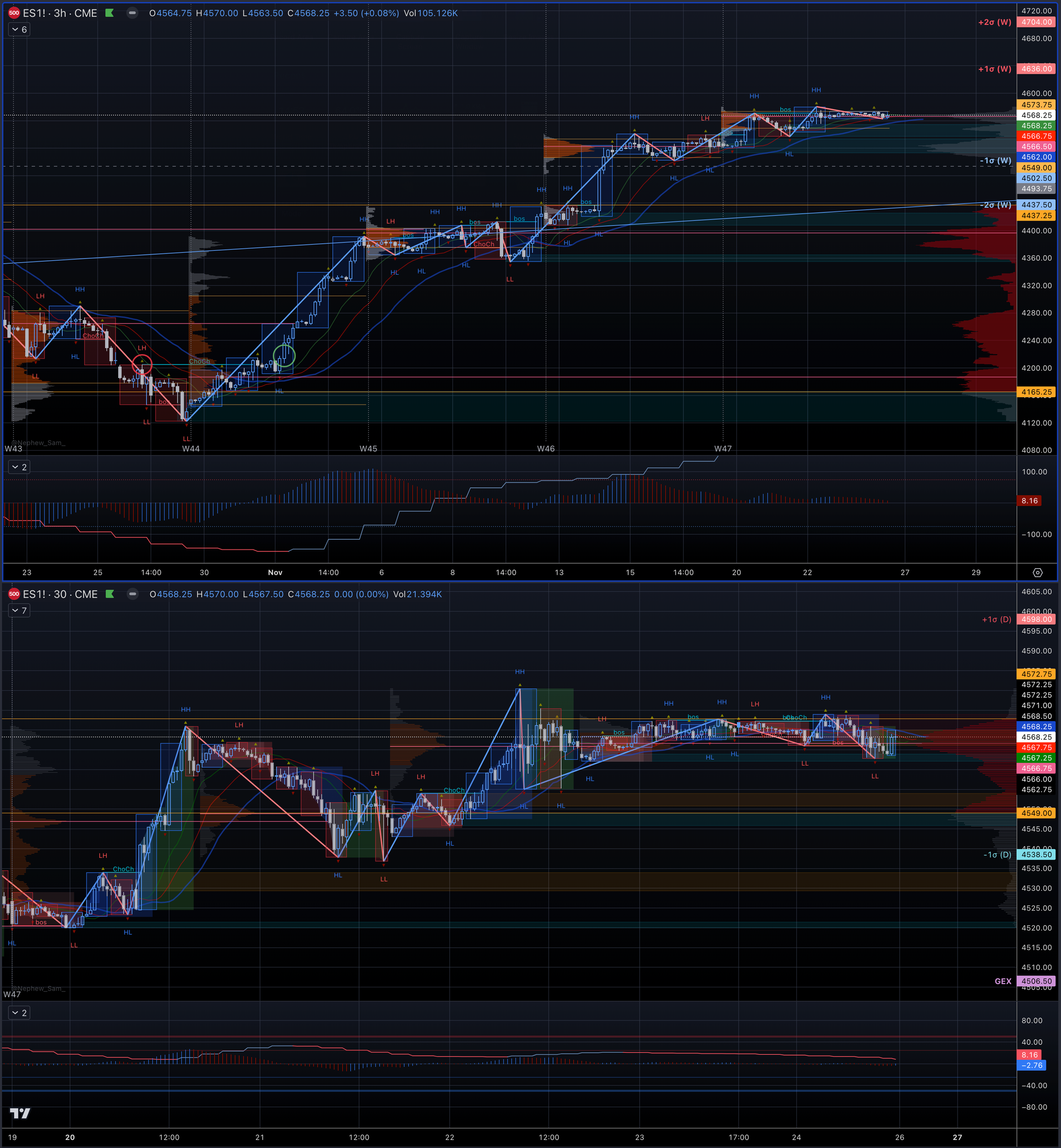

Bull v Bear

This Week (30d ATM IV 10.11% v 30d RVOL 14.94%)Bulls will seek to extend upside and price acceptance > WHI on a closing basis. Upside: 4600 (+0.70%) and YTD HI 4634.50 are within +1σ (W) 4636 (+1.48%).Bears will seek to cause cessation of DTF 1TFU on a closing basis. Downside: WLO 4520 (-1.06%) and GEX Flip 4506.50 are within -1σ (W) 4502.50 (-1.44%).

Last Week (4568.25 DEC23 +0.89%)Bulls will seek to extend upside > WHI and confirm a BOS > WHI 4541.25 on a closing basis. Upside: 4458 gap closure and 4600 is within +1σ (W) 4602 (+1.65%).Bears will seek to cause cessation of DTF 1TFU. Downside: Negative GEX < 4454.00 coincides with -1σ (W) 4455 (-1.62%); 4430.50 breakout backtest (-2.14%).